The Emergence and Importance of ESG Funds in Today’s Investment Landscape

Over the past half-century, we have witnessed a fivefold increase in climate and weather-related disasters, according to the World Meteorological Organization (WMO)1. The Intergovernmental Panel on Climate Change (IPCC) forecasts that we will need to spend between US$1.6 and US$3.8 trillion annually to prevent a further 1.5-degree Celsius rise in temperature by 20502.

Rising Environmental Crises: A Call for Responsibility

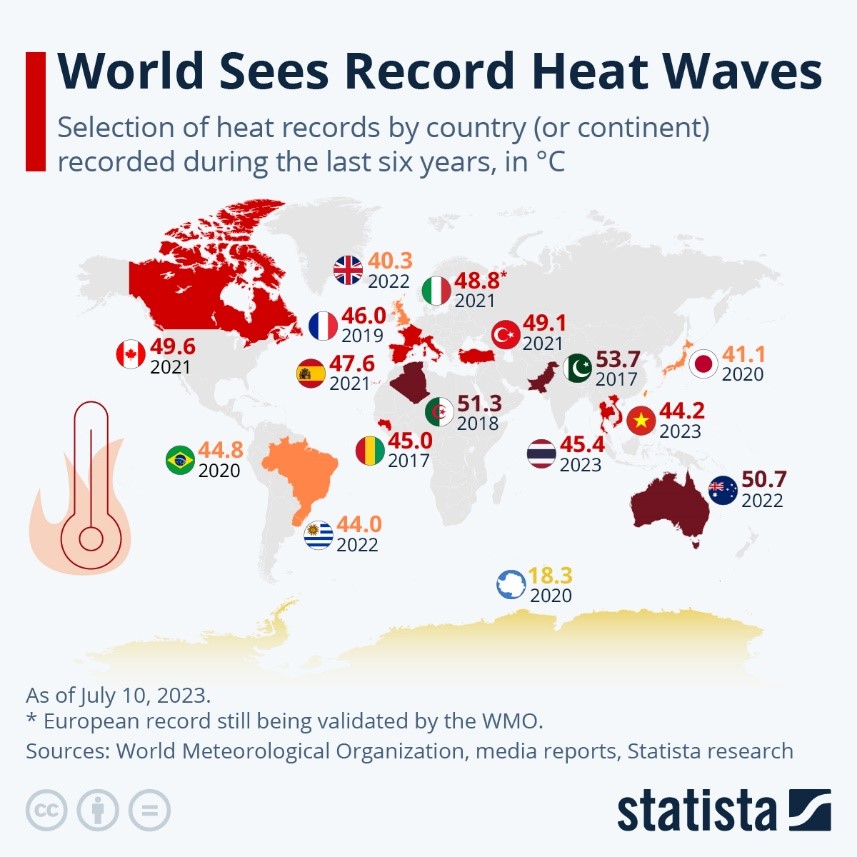

Brutal weather events have highlighted the importance of environmental responsibility. From 90% of Californians grappling with flood watches, impending mudslides, power outages, and deadly inundation, to Pakistan’s devastating floods which impacted 33 million people, the call to action has never been louder. With consecutive record heatwaves sweeping across the globe, the world’s climate situation is extremely serious3.

The Emergence of ESG Funds: A Response to the Climate Crisis

In this backdrop, Environmental, Social, and Governance (ESG) funds have emerged as a vital investment avenue for some investors. These funds may have garnered significant attention due to several driving factors:

- Regulatory Support: Governments worldwide increasingly support the transition to a lower carbon world. The European Union’s ‘Fit for 55’ package and ‘Inflation Reduction Act’’s $369 billion climate package initiated by The White House , are prime examples of regulatory initiatives to reduce our carbon footprint. Furthermore, China also aims to reduce carbon emissions to reach a “carbon peak” by 2030 and achieve carbon neutrality by 2060. These policies encourage industries to pivot towards renewable energy, creating investment opportunities in compliant companies.

- Increasing Social Responsibility: As the effects of climate change become more apparent and damaging, society is pushing for reduced carbon emissions. This societal pressure translates into a growing market for business models and technologies that mitigate environmental harm. Companies that prioritize environmental responsibility are likely to see increased consumer support, making them attractive investment prospects.

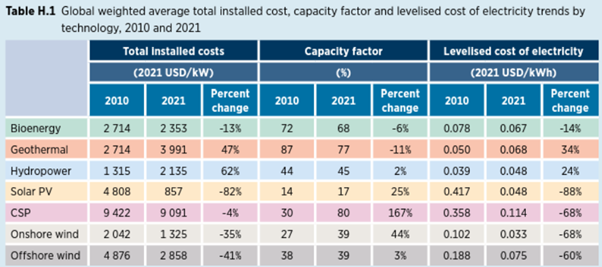

- Economic Viability: Renewable energy solutions are becoming increasingly cost-competitive. Over the past few years, we’ve seen a significant decline in the cost of renewable energy production, making it an attractive alternative to traditional energy sources. This trend opens up new investment opportunities within the renewable energy sector.

Source from Renewable Power Generation Costs in 2021 report by International Renewable Energy Agency6

As a consequence, investors are increasingly interested in sustainable economic development to drive growth and improve society and the environment. This interest has led to the rising popularity of ESG investment funds.

Key Themes in ESG Investment Funds:

- Renewable Energy: Countries and companies should consider low-carbon solutions such as wind, solar, geothermal power, and hydroelectric energy to control the rising temperature. Investments in renewable energy providers or potential reusable energy sources can yield both environmental benefits and significant returns.

- Energy Efficiency: Investments can target companies that focus on improving energy efficiency, reducing overall demand and associated carbon emissions. This can include equipment for wind and solar energy, energy transportation software, electric vehicle battery materials, and improving building energy efficiency.

- Clean Infrastructure Transportation: The transportation sector contributes significantly to global carbon emissions. Investment in electric vehicle manufacturers, related sub-suppliers, and emission reduction equipment suppliers for traditional Internal Combustion Engine (ICE) vehicles can support the transition to cleaner transportation alternatives.

In conclusion, ESG funds may offer a unique opportunity for investors to contribute to environmental sustainability while also achieving robust financial returns. In the current market landscape, these funds might cater well to investors seeking medium to long-term investments that also align with their values.

If you would like to understand this asset class and explore potential investment opportunities to diversify your portfolio, please talk to your financial advisor at OnePlatform Asset Management today.

[1] Data from World Meteorological Organization; [2] Data from IPCC; [3] Data from statista.com[4] Data from European Council; [5] Data from The White House; [6] Data from International Renewable Energy Agency

#Disclaimer and Notes

Investment involves risk. Investors should carefully consider whether any investment products or services mentioned herein are appropriate for investors in view of their investment experience, objectives, financial resources and circumstances. The information is for general information and reference only and does not constitute nor is it intended to be construed as any professional advice, offer, solicitation or recommendation to deal in any of the securities or investments. OnePlatform Asset Management Limited shall not be liable for any loss or damage caused by any person’s use or misuse of any information or content, or reliance on it. Please consider to seek professional advice before making any investment decision if needed.

Fund products and portfolio management services are distributed and/or rendered by OnePlatform Asset Management Limited (a licensed corporation with SFC CE No. AFQ784).

You May Be Interested In

OnePlatform Asset Management | 03 Jan 2024

Embracing Market Uncertainty: The Appeal of Multi-Asset Investments

OnePlatform Asset Management | 07 Nov 2023

Money Market Funds: A Credible Investment Amid Current Market Conditions